The market for data center hardware built to Open Compute Project specifications is exploding — and not only because of the demand from the hyper-scale cloud platforms.

The market for the OCP Foundation’s hardware grew 40% last year, reaching $3.6 billion in revenue, or 2.25% of the total market for servers, storage, network, rack, power, peripherals, and so on, according to Omdia, the research firm the OCP Foundation has turned to for taking the pulse of the market outside the companies that sit on its board.

That is the expected market size for non-board OCPs. It doesn’t include all of the steel that Facebook, Microsoft, and Rackspace have strewn across the concrete flooring of their data centers.

Facebook, Microsoft, and Rackspace were the only corporations that ran their own data centers and didn’t sell equipment with board seats until this year. During the foundation’s virtual conference this week, Google was revealed as the fourth member of the board.

Despite the presence of non-board hyperscalers such as Amazon, Baidu, and Google until this week, this is not a scenario in which a few large purchases are responsible for inflating total market numbers.

The contribution of non-board hyperscalers in the total market has fallen significantly during 2016 and 2017 and it isn’t projected to expand much in the near future. Enterprises, telcos, and tier-two cloud providers will be the main non-board Open Compute Project buyer segments in the future.

Getting Over COVID-19 Aftermath

Photo Credit: www.nijioni.com

Because of the vast diversity of user verticals represented in the overall statistics, research analysts do not expect the COVID-19 pandemic to have a significant influence on their projection. As a result of the pandemic-related lockdowns, demand for Tier 2 cloud providers and telecoms has increased.

However, pullbacks in the enterprise sector are highly likely, particularly by government agencies, which have had to spend vast sums of money to confront the crisis while seeing tax revenues plummet. It’s reasonable to anticipate that in the public sector, any renewal of equipment that can be postponed will be delayed.

Many private sectors are also in a state of flux, and it’s not obvious that they’ll be conducting any investment whatsoever in any form of equipment.

However, the headwinds encountered by some and the tailwinds experienced by others will surely balance out in the end.

Innovation Drivers Of Open Compute Project

Photo Credit: newsroom.intel.com

Servers have and will continue to account for the majority of OCP hardware purchases each year, but the range of technologies built inside the framework is expanding. This is especially true in the telecom category, which is one of the reasons Omdia expects the sector to continue to play such a large role in the ecosystem in the future.

There is a lot of focus within OCP, on cell-site network gateways, routers, and servers that are designed specifically for telco edge needs. It’s a market that’s looking for entirely new solutions, and now is the time for new suppliers and innovators to enter.

Telcos are drawn to Open Compute Project partly because of the ecosystem’s innovation and partly because disaggregation, which has been a major design aim across the company’s various initiatives, helps them avoid vendor lock-in.

Telecommunications equipment is known for its large, expensive proprietary solutions, in which all of the components in a single box are intended to function together. The open specifications mandated by Open Compute Project allow multiple suppliers to develop interchangeable components that can all work together to create a single solution. They’ve also opened the doors to new merchants.

More Enterprise Types Interested

The enterprise segment of the non-board OCP market grew significantly last year, from under 30% to over 40%, because of increased purchases by government agencies, gambling, e-commerce, and energy organizations, as well as a moderate increase in installations by automotive and industrial customers.

Open Compute Project was being used by several organizations to provide high-performance computing infrastructure. Open Compute Project proof of concept deployments have been deployed by automotive and industrial users to provide edge computing for connected car and internet of things activities, respectively.

Accessibility As The Biggest Issue

While the non-hyperscale market for Open Compute Project equipment is developing, smaller-scale purchasers continue to find the equipment difficult to come by. On the vendor side of the ecosystem, most of the large players have typically concentrated on hyperscalers and haven’t created the supply chain and support infrastructure that smaller businesses want from their hardware providers.

Although access has improved over time, it remains a problem. That barrier still exists today, albeit to a lesser extent. The situation isn’t completely fixed.

Some suppliers have begun to provide server orders as little as one or two servers, and there are already robust networks of Open Compute Project resellers and integrators in some areas.

The circular economy has also been recognized by Omdia as a new, possibly significant growth factor for non-hyperscale OCP adoption. ITRenew, a company that specializes in decommissioning and reselling obsolete hyperscale data center equipment, has been repurposing some of it into wide market-friendly systems that are certified for standard software platforms like VMware. Ali Fenn, the company’s president, said that there has been a lot of interest in these solutions, particularly from tier-two cloud providers.

Next-Gen Data Centers with AKCP

The data center industry is seeing significant growth due to the acceleration of cloud and edge computing, AI, and as-a-service solutions. And the data center ecosystem has never been as complicated as it has ever been. The Open Compute Project (OCP) is an effort to simplify that environment by bringing together the brightest brains in the industry to chart a course ahead.

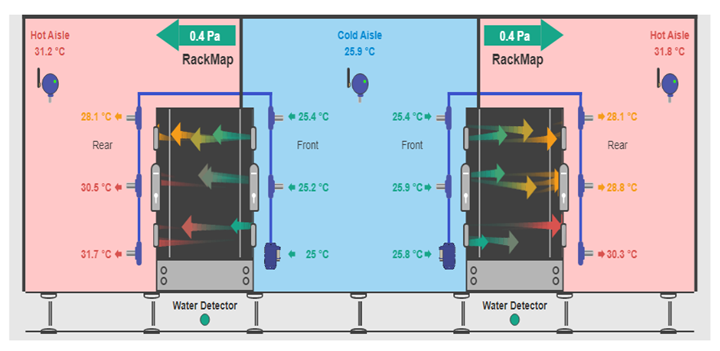

As new issues in higher-power workloads, interoperability, and maintenance have emerged. AKCP provides end-to-end monitoring while delivering considerable power, performance, and cost savings solutions. Datacenter operators may track system health in mission mode while relying on past data from production to prevent failures and maintain continuous service availability.

AKCPro Server

AKCPro Server is a world-class software for Data Center Infrastructure Management (DCIM). Avoid the complexity and cost of many popular DCIM software. AKCPro Server distills the essence of what DCIM should be to a simple, easy-to-use application. Configure dashboards to display the data you need, with drill-down mapping taking you from a data center-wide to a cabinet-level view. A dedicated rack map shows smart rack sensors such as thermal maps and RFID Swing Handle lock information in a graphical display.

Monitor All Your Base Units

buildIf you have many base units installed across youring or over a vast area, add each one to your AKCPro Cloud Server and log in at any time to see all of your sensors grouped on custom desktops as you desire. For various users that need to view different data, multiple logins might be utilized. Display sensors on drill-down maps.

Alerts In The Cloud

AKCess Pro Cloud Server supports e-mail, SNMP Trap, SMS, and phone-call notifications. Create your own e-mails or use our e-mail service to send an infinite number of e-mail notifications. For a set annual price, SMS and phone call notifications can be issued. When your sensors are in critical condition, you’ll know it.

Reference Links:

https://www.datacenterknowledge.com/hardware/open-compute-isn-t-only-hyperscale-data-centers-increasingly-so

https://searchdatacenter.techtarget.com/definition/open-compute-open-compute-project

https://www.amd.com/en/technologies/open-compute